Long-Term Investing: Why You Need to Start Today

Many new investors believe you need a large amount of money to start. In reality, long-term investing is about consistency and time in the market. Even small contributions, made regularly, can compound into significant wealth.

Historical Example

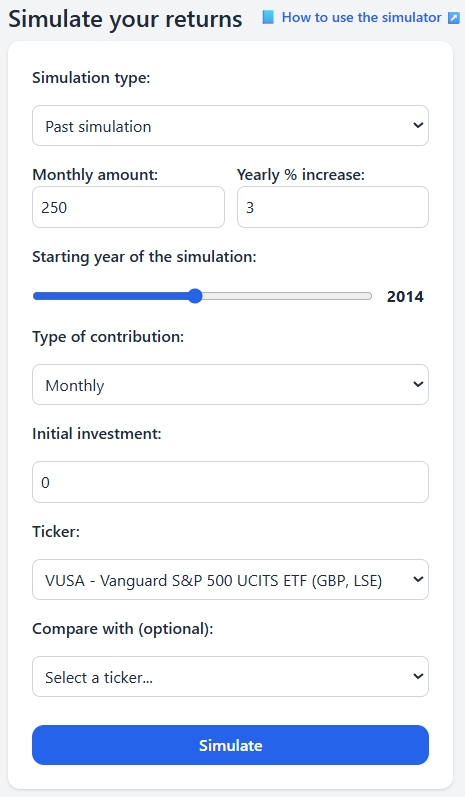

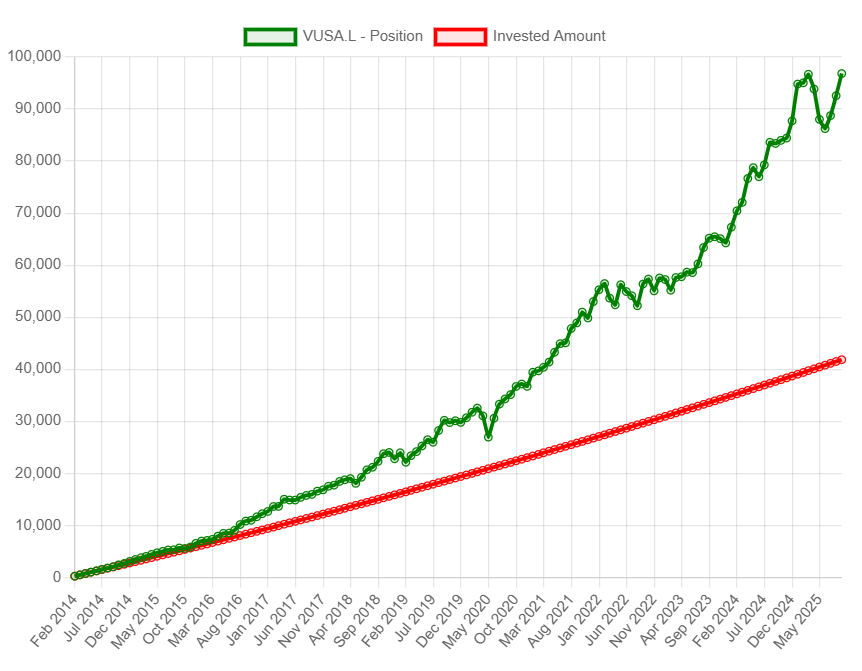

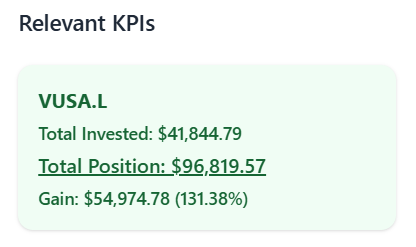

Let’s imagine you had invested 250 USD every month since 2014 in a low-cost S&P 500 index fund (ETF), increasing your contribution by 3% per year to keep up with inflation. Over the last 10 years, with average annual returns of about 7% after inflation, your portfolio would now be worth more than 96,000 USD. That’s a 131% increase over the total money you invested — a clear example of the power of long-term investing and compound growth.

Please allow me to show you an investment simulation using the parameters described above, and we will use the low-cost ETF VUSA, based on the S&P 500:

Let's click on simulate and review the results:

We can clearly see how positive investment returns start to accelerate after a certain point in time. This not only increases our overall wealth, but the consistency of contributions also protects us against bad years in the market. This is the essence of long-term investing: regular small investments, patience, and letting compound growth do the heavy lifting.

Try the Investment Simulator Yourself

Curious about how your own contributions could grow? Use our free investment simulator to test different scenarios and see how much your portfolio could be worth in the future.

Key Takeaways

- You don’t need a lot of money to start investing — consistency is key.

- Long-term investing works best when you reinvest returns.

- Even small yearly contributions can become large sums thanks to compound interest.

- Use an investment calculator or simulator to see your potential results.

Ready to explore your own scenario? Click the button above and try our WealthSimulations investment calculator today.